TaxSlayer Pro + Surgent Professional Education

TaxSlayer Pro® has partnered with Surgent Professional Education to provide tax preparers with industry-leading exam prep and continuing education resources.

Who is Surgent?

As a leader in accounting education for 35 years, Surgent Professional Education is the partner tax preparers need to realize all the benefits of an investment in professional education. From their intelligent adaptive learning-based Exam Review courses to their industry-leading CPE programs, they’ll help ensure that everyone from the newest associate to the most experienced professional is learning, growing, and performing at their peak levels of performance.

Surgent exam review

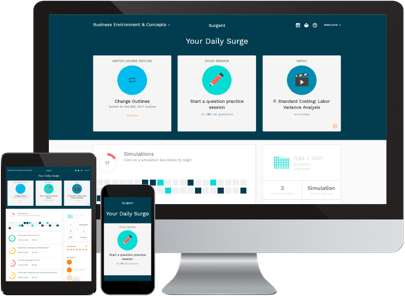

Surgent developed a proprietary software, A.S.A.P. Technology™, that determines what you know (and don’t know) and customizes a study plan to match.

How A.S.A.P. technology ™ works:

Assessment

Complete a series of quizzes with content pulled from all exam categories. At the end of the assessment, receive a diagnostic report detailing starting strengths and weaknesses.

Study

Surgent’s software continuously analyzes unique scoring patterns and builds a custom study plan, focusing on the specific content preparers need to learn to pass the exam. Meanwhile, real time algorithms optimize the study plan along the way.

Review

Unlimited practice exams, designed to match Exam, ensure students will be ready come exam day. And with Surgent’s ReadySCORE feature, students know when they’re ready to pass.

Achieve impressive pass rate

EA Review students pass 96% of the time!

Get exam-ready faster

The average CPA Review student is ready to pass with 80% fewer study hours than what competitors would require.

Estimate exam scores with 99% accuracy

ReadySCORE helps preparers see accurate expected scores

Surgent CPE

Today's tax and CPA professionals must stay on top of the key tax and accounting changes that affect their firms and clients, while also earning continuing education credits they need to stay compliant. Surgent makes it easy to do both. That’s because they offer the widest variety of courses for CPAs, attorneys, and other tax, accounting, and finance professionals. Their up-to-date courses make even tough concepts clear and relevant, while their comprehensive schedule of both live and on-demand formats makes it easy to fit into the busiest schedule.

Surgent’s flexible-access options provide a cost-effective and convenient option for tax preparers and CPAs.

- Live webinars: Get the benefits of live seminars without leaving your office or home by attending one of 1,200+ public webinars offered annually. Purchase individually or with Surgent’s Unlimited Webinar or Unlimited Plus packages for CPAs.

- On-Demand webcasts: Get access to 130+ on-demand webcasts. Set your own schedule and earn between 2-16 credit hours per webcast.

- Self-Study: The Self-Study program provides flexibility to learn on any schedule and at any pace. Formats include on-demand webcasts, downloadable PDFs and textbooks. Self-Study courses may also be purchased individually or with an EA packages or Annual Filing Season Program package.

Exclusive offers for continuing education

Log into your Account Hub to get access to these exclusive offers.

Log InNot a Pro customer?

Download a free demo today.