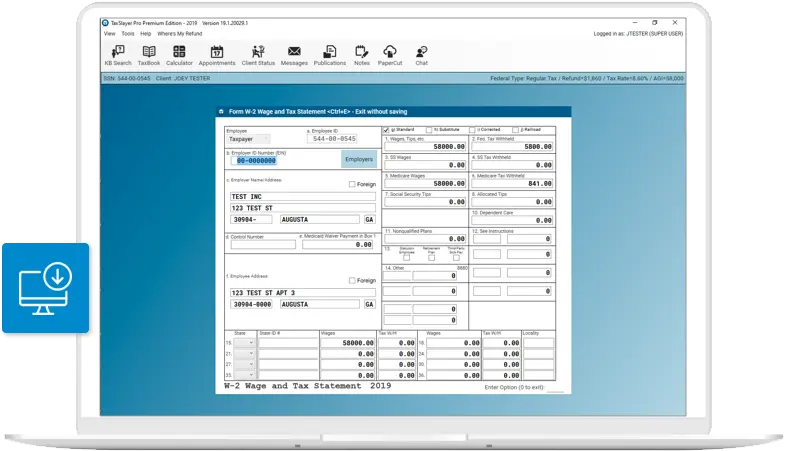

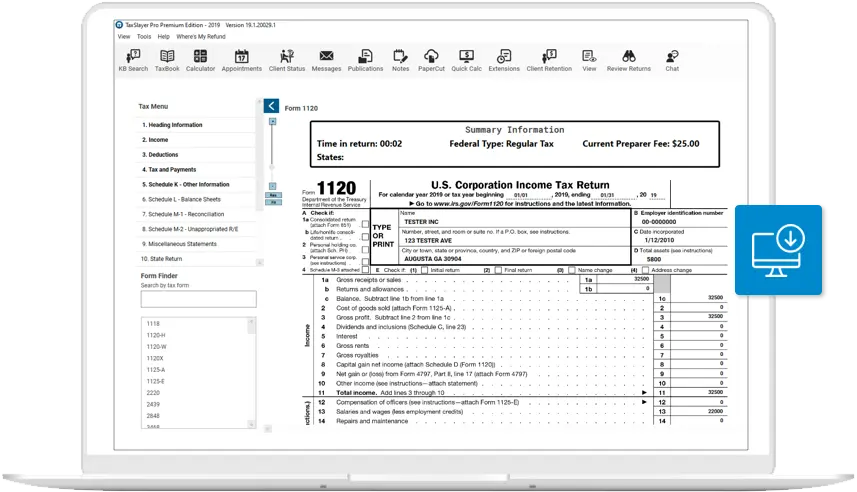

All-inclusive tax preparation software

TaxSlayer Pro Classic includes everything you need to prepare, file, and transmit your clients' individual tax returns.

Features

With an unlimited 1040 program and award winning professional technical tax support, TaxSlayer Pro is the choice for professional tax preparers.

Bank products

Bank products, or refund transfers, allow your clients to deduct your tax preparation fees directly from their refund, which means that they will have zero out-of-pocket fees when filing with you.

Free unlimited filing

Enjoy no limit to the number of tax returns that can be prepared and filed with your TaxSlayer Pro software. We don't charge you per return, so you don't feel limited and can continue to grow your business.

Depreciation module

TaxSlayer Pro’s Depreciation Module makes it easy to enter your client’s assets, select the correct depreciation method, and transfer the calculated depreciation expense to the proper line on the return.

Unlimited top-rated support

TaxSlayer Pro includes year-round support with every software purchase. Support available in both English and Spanish. No additional fees.

All states included

File returns for all states that require income, interest, dividend, and other filing.

Easy start onboarding

We have an easy to use, on-demand new user webinar to help you get started quickly.

Request your free demo of TaxSlayer Pro today!

Download your copy and do everything except submit a return. Don't miss any of our great features.

Try it for freeTax software built by professionals, for professionals

At TaxSlayer Pro we know what's important to you. With Classic, file unlimited returns and get award winning professional tax support.

All-inclusive tax software

Professional tax software built by and for tax preparers. Prepare 1040 federal, state, and local tax returns.

Integrated bank products

Get your clients their refund fast and get paid sooner through one of our four bank partners.

Unlimited support

Support available in both English and Spanish. No additional fees.

Easy start onboarding

We have an easy to use, on-demand new user webinar to help you get started quickly.

Grow your business with TaxSlayer Pro

Trusted by tax preparers nationwide since 1989. See why over 93% of tax preparers stay with us after making the switch.1 Includes corporate tax software for small and large tax practices.

Purchase Now