The information in this article is up to date for tax year 2023 (returns filed in 2024).

To maintain a healthy influx of new clients, your tax preparation business needs a carefully planned and executed customer acquisition strategy. Customer acquisition not only helps you avoid dips in income due to client loss, but it also allows you to grow your client base and significantly increase your income over time.

Even with minimal marketing experience, you can develop and implement a client-winning customer acquisition strategy for your tax preparation business. These methods and principles will help you design a diverse, effective marketing plan that will attract new customers.

Top Customer Acquisition Strategies

Content Marketing

The biggest advantage of content marketing is that it allows tax preparers to position themselves as thought leaders within their industry. The more you share your knowledge in the space, the more potential customers are likely to trust you with handling one of the most complicated financial matters of the year–their taxes.

Essentially, content marketing involves providing resources and content that are of value to your potential customers. You can do this through a variety of mediums; some of the most common forms of content marketing today include:

- Blog posts

- Videos

- Infographics

- Social media posts

Content marketing doesn’t just happen online. Physical materials can be just as valuable in establishing your credibility as a tax expert. Think printed brochures and handouts or interactive screens in your office’s waiting room.

Whether it’s online or printed, content marketing helps your tax business gain attention, credibility, and authority. Online content marketing can also significantly increase the success of other strategies like SEO, email marketing, and social media.

SEO (Search Engine Optimization)

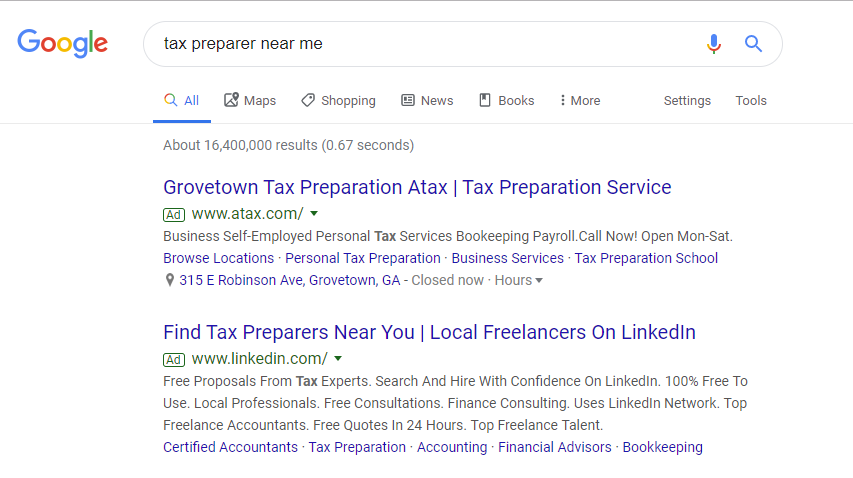

Appearing on search engine results pages (SERPs) is a goal for all small business owners. You can get there in two ways: organically or through paid search. If you want your business to appear in search results naturally, you’ll need to focus on your SEO.

Paid search

Paid search results appear at the top of the page and are marked as “Ads”.

Organic Search

Organic search results are naturally selected by the search engine’s algorithms. Statistically, users are more likely to click on organic results than paid search results.

Learning the intricacies of SEO takes time, but these basics will get you started:

- Include relevant keywords throughout your website, especially in headings and subheadings. Free tools like the Google Keyword Planner and resources from trusted sites like Hubspot can help you identify the keywords you want to target. Just be careful not to fall into keyword “stuffing.”

- Update your website regularly. Search engine crawlers favor regularly updated sites. Maintaining a regular blog can help with this.

- Focus on local SEO. If you’re like the majority of tax preparers, most of your clients will be local. Plus, ranking for local searches will be easier and ultimately more impactful than ranking for general “tax preparer” searches. Be sure to include your geographic area in your targeted keywords.

If you find that the process of learning and implementing SEO is too overwhelming or time-consuming, many local digital marketing agencies can help you build an ongoing SEO strategy. Most of these agencies can help with things like content marketing and social media.

Social Media

With a solid strategy, social media can be a powerful tool for your business. Are you making the most of it? Our guide, Social Media 101 for Tax Preparers, can help you learn about implementing an effective and manageable social media strategy.

Email Marketing

Email marketing helps you connect with existing clients and convert leads into paying customers. Your email strategy can include regular newsletters, special deals and discounts, and links to any content that’s interesting and relevant to your client base.

Customer Referrals

Eighty-three percent of consumers trust the recommendation of family and friends, making word-of-mouth by far the most trusted form of “advertisement.” With low cost and potential for high returns, customer referrals should be a part of your customer acquisition strategy. Read our article to learn more about the importance of customer referrals.

The Basics of a Successful Customer Acquisition Strategy

A successful customer acquisition strategy will be scalable, diverse, and sustainable. Continue reading to learn how to achieve these goals.

Scalability

Ideally, your marketing methods will become more effective over time without becoming significantly more expensive. Paid marketing tactics — like paid search or social media ads —may plateau over time in terms of how many new customers they bring in.

You’ll likely have to increase your investment to gain more clients through these methods. However, something like a company blog will usually become more effective the longer you have it without becoming more costly.

Diversity

The cliché of putting all your eggs in one basket definitely applies to your marketing strategy. If you depend entirely on a single strategy for your marketing, you’re missing out on potential clients. You’re also more vulnerable to changes in consumer preferences and behavior.

Sustainability

Will you be able to post consistently to your blog and social media accounts? Can you continue to afford your paid search advertisements? When you develop your strategy, make sure that the investment of time and money is a long-term, sustainable choice for your business.

Evaluating Your Strategy with Customer Acquisition Cost

When you implement a customer acquisition strategy, track your marketing expenses and how many new clients you gain through a campaign. Doing so allows you to calculate your customer acquisition cost or CAC. In the simplest terms, your CAC is your total marketing costs divided by the number of new clients. For example:

$400 for a marketing campaign / 20 new clients = a CAC of $20

While CAC isn’t the only metric that matters when it comes to your marketing budget, it’s important to figure out which campaigns are most effective.

You’ll likely want to track your CAC in a few ways: per campaign, per quarter, and total.

Per Campaign

Tracking your CAC for a particular campaign allows you to see which marketing methods yield the best ROI (return on investment). Let’s say your customer acquisition plan consists of:

- An incentivized referral program

- Social media strategy

- Search Engine Optimization (SEO)

- Content marketing with a blog

Calculating the CAC of each individual component helps you identify the strengths and weaknesses of your marketing plan.

Be careful not to make judgments too quickly as some marketing strategies don’t offer immediate results. Methods like content marketing, for example, take longer to generate results but will eventually play an integral role in your lead generation.

Per Quarter

Calculating CAC per quarter allows you to see how certain strategies pay off over time. The time and money you invested in your blog or social media presence one quarter may begin to pay off two or three quarters later. With this data, you’ll know when you can expect your efforts to pay off.

Total

Your total CAC combines the cost of all of your marketing strategies. Knowing total CAC is helpful since many marketing strategies intersect with one another. New customers may encounter your social media, blog, and email campaigns before becoming a customer. This can make assigning credit for a new customer to one particular marketing strategy difficult.

Customer Lifetime Value

CAC is only part of the story. You need to know how much revenue you can expect from each new customer, to determine if your CAC has been a worthwhile investment. This is how you can analyze the Customer Lifetime Value (LTV) comes in. Customer LTV refers to the profit a customer will bring you throughout their relationship with your company.

Spending $10 per new customer doesn’t make sense if those customers are making one-time purchases of $10. But if they make larger purchases or become long-term returning customers, a CAC of $10 is a better investment. Generally, an LTV:CAC ratio of 3:1 is considered ideal.

Customer acquisition is vital to the health of your tax preparation business. Build a solid marketing foundation, and your business will be rewarded with more customers and increased revenue.

These strategies will help you refine, diversify, and evaluate your efforts. The result will be a customer acquisition strategy tailor-made for your business.